When a loved one passes away, families often think they must face the complex legal process called probate, but many times that is simply not true. If you’re dealing with this situation, you likely have many questions about what probate is, whether you need to go through it, what it involves, how long it takes, and what it costs.

This comprehensive guide answers the most common probate questions Arizona families ask, helping you understand your options and make informed decisions during a difficult time.

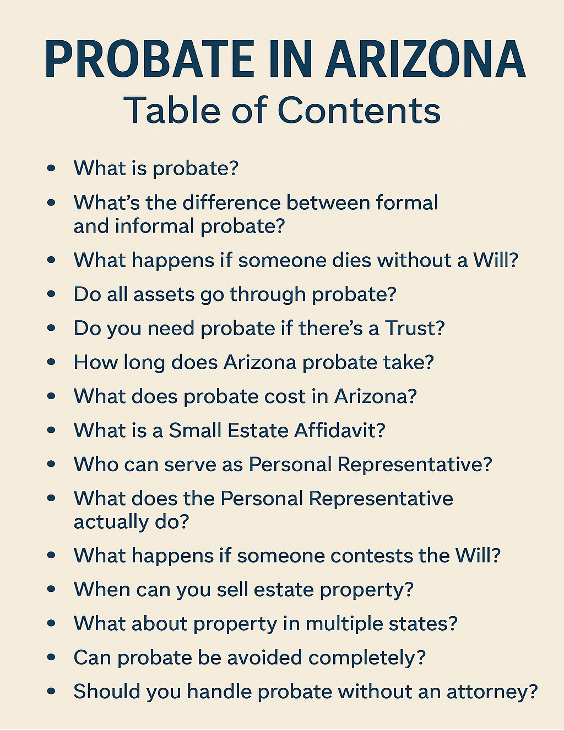

1. What Is Probate?

Simple answer: Probate is the legal court process that gives a person special powers to sell/transfer a deceased person’s property and pays their final debts.

More specifically, probate:

- Confirms if there’s a valid Will

- Appoint someone to handle the estate (called a Personal Representative)

- Collects and value all property

- Pay debts and taxes

- Distributes what’s left to the right beneficiaries

Key Points: Arizona has four (4) kinds of probate:

- Informal (simpler, less court involvement)

- Formal (judge hearings, used when disputes exist)

- Supervised (judge watches everything)

- Small Estate (under the money threshold)

2. What’s the Difference Between Formal and Informal Probate?

Informal probate (faster, simpler) is available when:

- Everyone in the family agrees on who is going to be in charge and how to divide things up

- Nobody is planning to challenge the Will

- The estate is fairly straightforward (house, bank accounts, personal items)

Example: Mom left a Will naming her daughter as Personal Representative, all three kids agree with the Will, and the Estate includes a house and some bank accounts.

Formal probate requires court hearings, often used when:

- Cannot find the original Will

- There is no Will and the siblings cannot agree who will be appointed with the power

- Family members are fighting about the Will or how things should be divided

- Someone wants to challenge whether the Will is valid

Key Point: Formal probate requires hearings at the start of the case, which will delay the appointment of a Personal Representative.

3. What Happens If Someone Dies Without a Will?

If there’s no Will (called dying intestate), Arizona law decides who inherits:

- Spouse receives 100% unless there are step-children

- Children

- Parents (if there’s no spouse or children)

- Brothers and sisters

- Other relatives in order of how closely related they are

Example: If a married person dies without a Will:

- And, some children are from a prior relationship: The surviving spouse gets half of the separate property. The children get the other half of separate property plus the deceased spouse’s share of community property

4. Do All Assets Go Through Probate?

No. Some assets skip probate automatically:

- Property held/owned in a Living Trust

- Bank accounts with “payable-on-death” names (the money goes directly to whoever you named) or accounts with a co-owner

- Life insurance policies and retirement accounts with beneficiaries listed

- Property owned jointly with your spouse (it automatically becomes theirs)

- Vehicles with “transfer-on-death” titles (ownership automatically transfers to the person you named)

Assets that usually require probate:

- Real estate in the deceased person’s name alone

- Bank accounts with no beneficiary named

- Personal belongings (furniture, jewelry, collections, etc.)

- Business ownership

- Investment accounts without transfer-on-death forms

Simple test: If an asset has the deceased person’s name alone on it and no beneficiary designation, it probably needs probate.

5. Do You Need Probate If There’s a Trust?

Not always. A properly funded Living Trust avoids probate for assets titled in the Trust.

But probate may still be needed for:

- A house/land that was never transferred to the Trust, or that was removed from the Trust

- A car without transfer-on-death paperwork

- Bank accounts that weren’t changed to the Trust’s name

- Personal property that wasn’t officially moved to the Trust

Key point: Even people with Trusts sometimes need probate for assets that weren’t properly moved into the Trust before they died.

6. How Long Does Arizona Probate Take?

- Minimum: 5–6 months (due to mandatory 4-month creditor claim period).

- Typical: 6–8 months for simple estates.

- Complex cases: 1–2 years if there are disputes or unsold property.

Families are often surprised by the creditor waiting period, but they are still surprised with how fast probate can end.

7. What Does Probate Cost in Arizona?

- Court filing fees: $251-$381 (depends what county in Arizona)

- Attorney fees: $3,000-$10,000+(depending on estate size and disputes)

- Complex estates (businesses, lawsuits, multiple properties): $10,000-$50,000

Money-saving tip: Estates worth less than $300,000 may qualify for a much simpler (and cheaper) process called a Small Estate Affidavit.

8. What Is a Small Estate Affidavit?

Arizona offers a shortcut if the estate is small, sometimes known as the Affidavit of Transfer of Real Property, Affidavit of Succession of Real Property, or the Affidavit process:

- Personal property affidavit (for estates under $200,000 in personal property). Can be used 30 days after death.

- Real property affidavit (for real estate equity under $300,000). Can be used 6 months after death.

Requirements:

- Debts and taxes must be paid first

- Cannot be used if disputes exist

Example: Dad died with $50,000 in bank accounts and a paid-off car. The family can use the small estate process instead of full probate, saving thousands of dollars and months of time.

9. Who Can Serve as Personal Representative?

Priority order:

- Person named in the Will

- If no Will:

- Surviving spouse

- Adult children (equal priority)

- Other close relatives

Important: Even if someone is named in a Will, they can’t legally act until the court officially appoints them. The Will has no power until it is admitted into probate court.

10. What Does the Personal Representative Actually Do?

Responsibilities include:

- Filing court paperwork for appointment

- Notifying heirs and creditors

- Preparing an inventory of assets

- Selling assets

- Paying bills and taxes

- Distributing property at the end

Big responsibility: Personal representatives can be held personally responsible if they make serious mistakes, so most people work with an attorney.

11. What Happens If Someone Contests the Will?

A few common reasons:

- Lack of mental capacity

- Under influence or coercion

- Forgery or improper signing

What happens: Will contests require formal probate with court hearings, witness testimony, and sometimes expert opinions. This can add months or years to the process and significantly increase costs.

12. When Can You Sell Estate Property?

It depends on the situation:

- Informal probate: The Personal Representative can sell assets immediately (same day) after being appointed by the Court.

- Formal probate: May need specific Court permission, especially for real estate

- Will restrictions: Some Wills include specific instructions about what can or can’t be sold

- The Affidavit process: transfers property into the person’s name that signs, and then they can sell out of their own name.

13. What About Property in Multiple States?

Each state requires its own probate process.

Example: An Arizona resident who owned a vacation home in California would need probate in both Arizona (for everything else) and California (for the vacation home).

14. Can Probate Be Avoided Completely?

Yes, with planning. Here are the most effective ways:

- Living Trusts: Put your house and major assets in a Trust. When you die, the Successor Trustee can distribute everything without Court involvement.

- Beneficiary designations: Name beneficiaries on bank accounts, retirement accounts, and life insurance. These transfer automatically. Real estate requires a recorded Beneficiary Deed.

- Joint ownership: Own property jointly with your spouse. When one dies, the survivor automatically owns everything.

- Transfer-on-death forms: Available for cars, investment accounts, and some other assets. Ownership transfers automatically to whoever you named.

- Small estate planning: Keep your estate under $300,000 to qualify for Arizona’s simplified procedures.

Bottom line: Good estate planning can eliminate or significantly reduce probate costs and delays for your family.

15. Should You Handle Probate Without an Attorney?

Arizona law allows you to represent yourself, but probate is technical, deadline-driven, and can be risky.

Consider hiring an attorney for:

- If the Court needs to be involved (small estate affidavit not available)

- Any family disagreements

- Business ownership or complex assets

- Property in multiple states

- If you live out of state

- If you are busy, do not have the time or the desire to handle the probate

Cost vs. benefit: Attorney fees often prevent much more expensive mistakes and delays. Most families find the guidance invaluable during an already stressful time.

Want to learn more? Visit our website for 113 FAQ’s. Click here.

Legal Disclaimer: This information is for educational purposes only and does not constitute legal advice. Arizona probate law is complex and varies based on individual circumstances. Always consult with a qualified probate attorney for guidance specific to your situation.