Probate Administration in Arizona

Simplified Probate: Your Guide Through Arizona Estate Administration.

It Might Be Your First Time Navigating Probate—But It’s All We Do.

We do not handle other types of cases. At Rahnema Law, we’ve helped hundreds of Arizona families through the probate process. We’ll make it simple, clear, and fast—so you don’t have to do it alone.

What Is

Probate Administration?

At Rahnema Law, we handle every step of the probate process, including:

- Validating the will: Officially confirming the deceased's last wishes with the court.

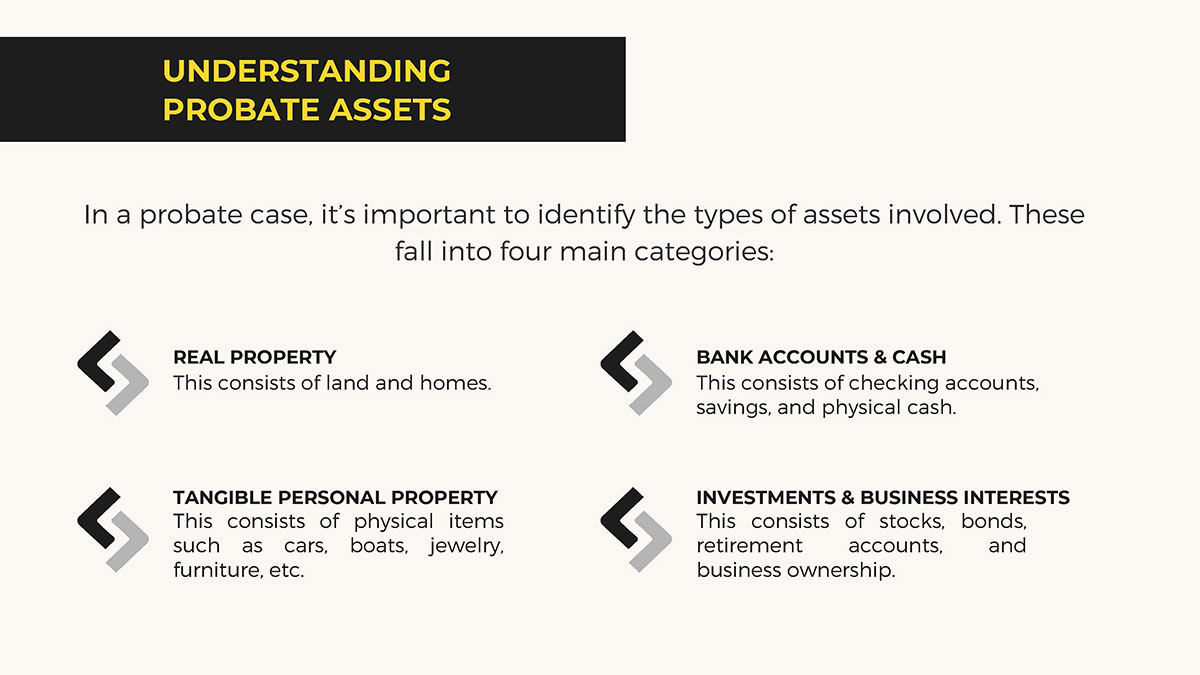

- Identifying assets: Locating and valuing all property owned by the estate.

- Paying debts and taxes: Managing all financial obligations of the estate.

- Distributing assets: Ensuring remaining property is correctly distributed to heirs and beneficiaries.

We simplify this complex process, guiding you from start to finish so you can focus on healing.

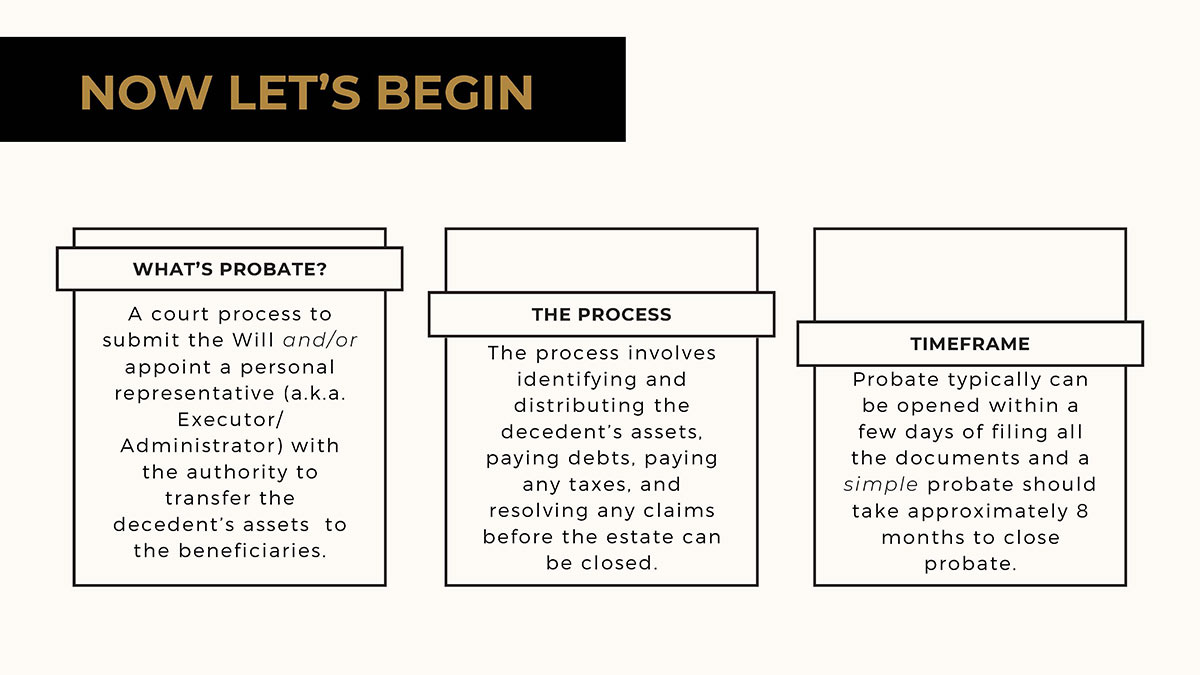

Understanding Probate

Common Questions

1. Do I Need Probate If There’s a Will?

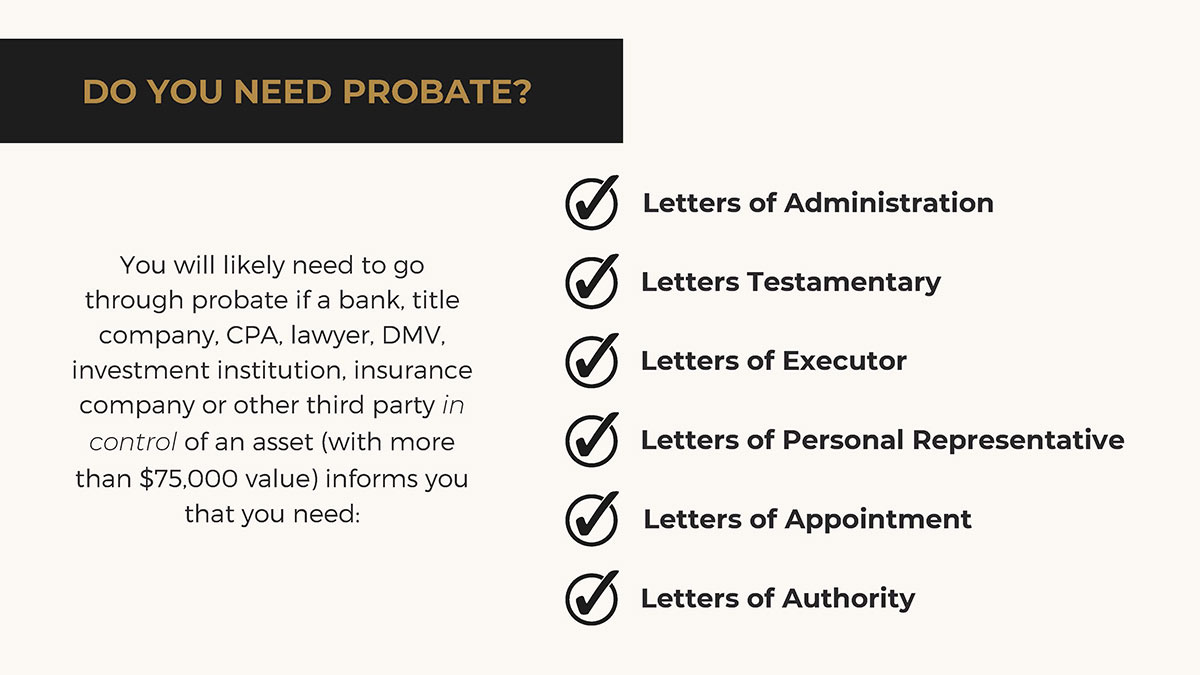

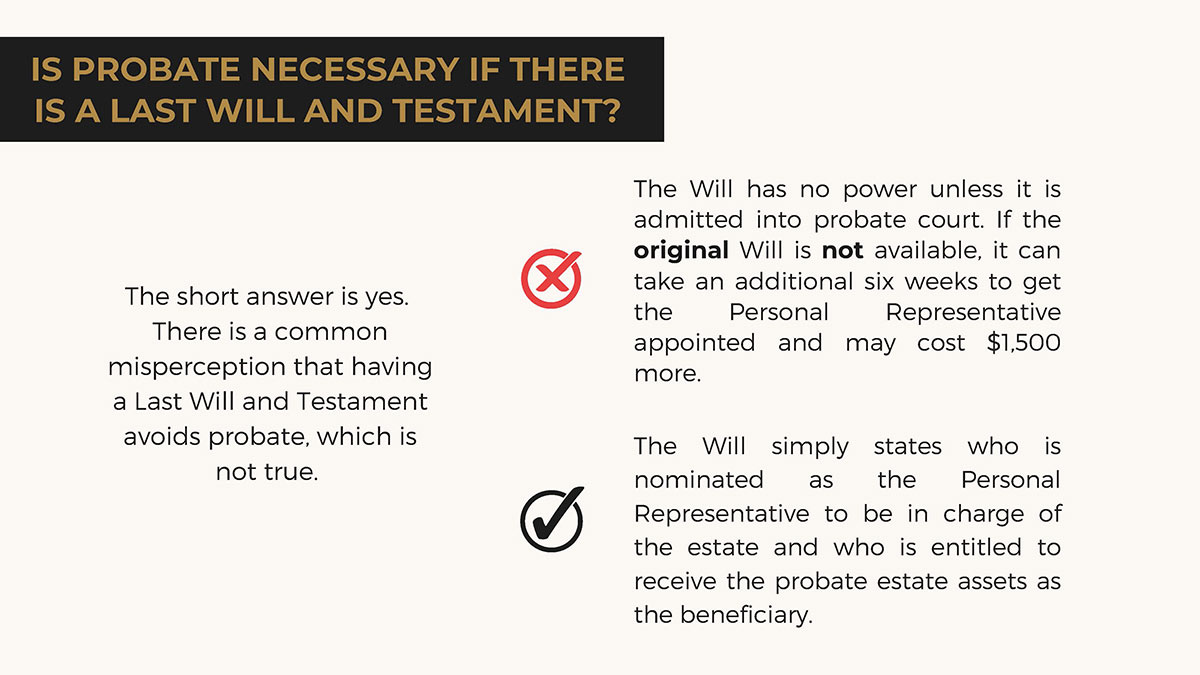

Yes, even with a valid will, probate may still be needed to transfer assets legally. The Will has no power unless a Personal Representative is appointed.

2. How Fast Can I Get Appointed by the Court?

Depending on your situation, it might be as quick as 1 week.

3. When Can I sell Assets?

The day you are appointed and have your Letters.

3. Do I Need to Come to Arizona?

Not for the probate process, but maybe- to obtain personal property in a home.

For a full list of FAQs, visit our dedicated Probate FAQ page.

Learn Probate Administration

6 Common Myths

About Arizona Probate

Myth #1: Having a Will Avoids Probate

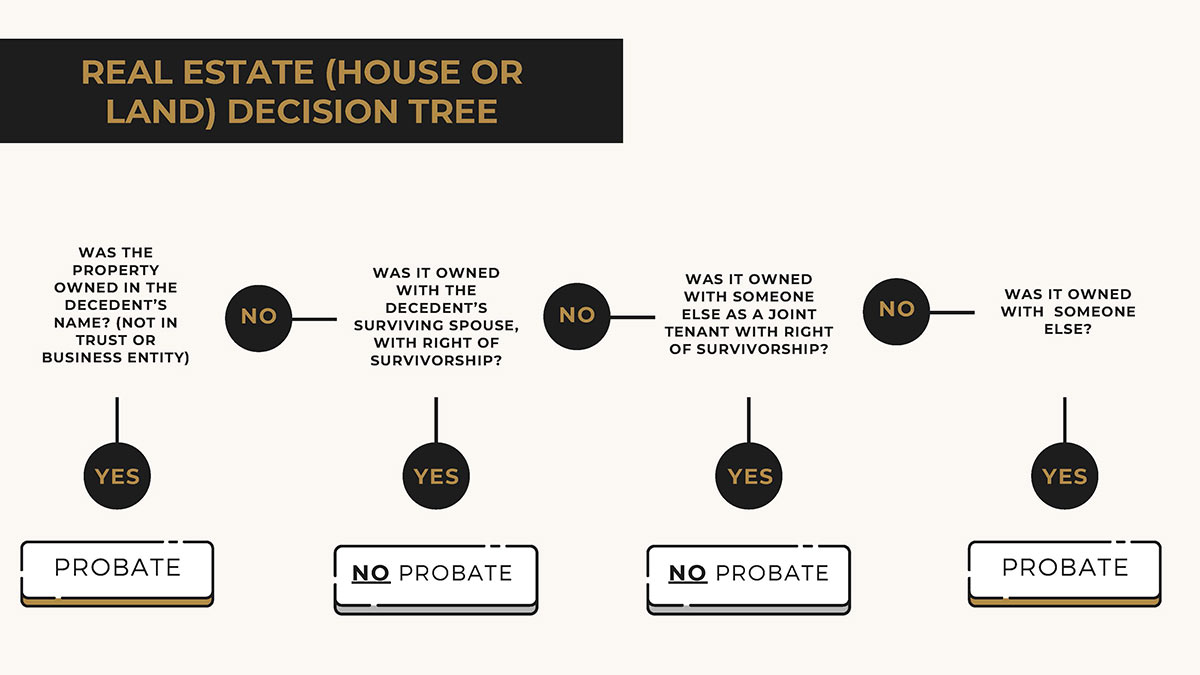

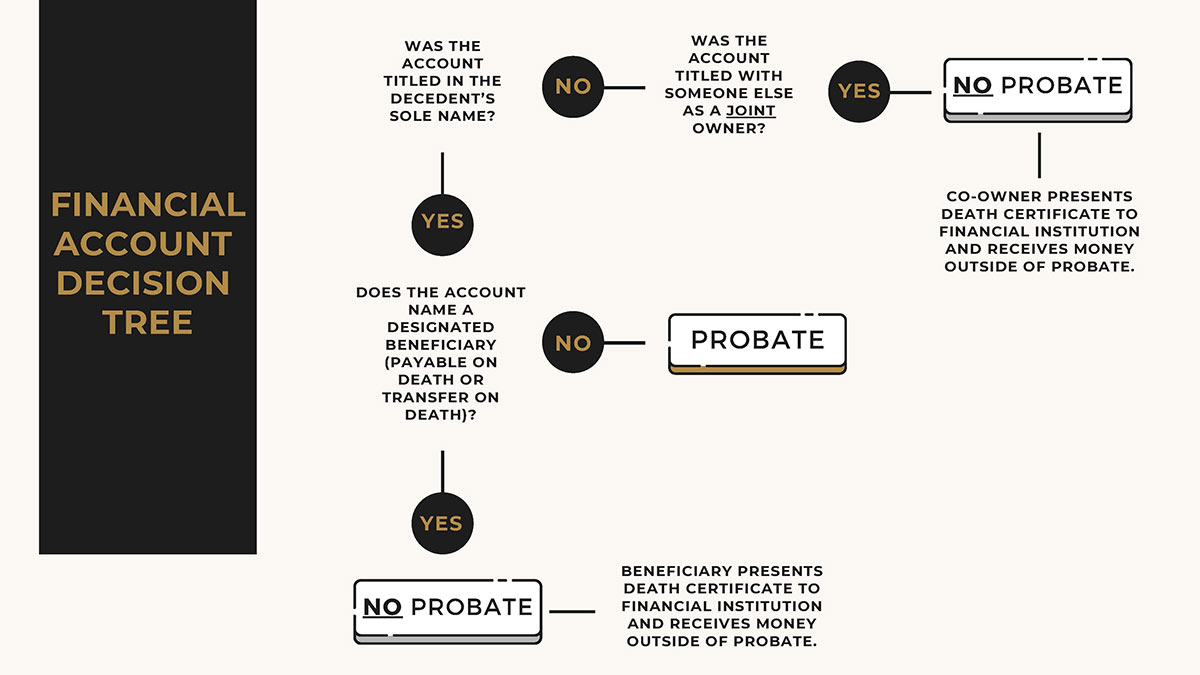

The Truth: A will actually requires probate—it doesn’t avoid it. Think of a will as instructions for the court on how to distribute your assets. To truly bypass probate, you need trusts, beneficiary designations, or payable-on-death accounts.

Myth #2: Probate Always Takes Years and Costs a Fortune

The Truth: Arizona probate is typically quick (2-3 months) and inexpensive (under $5,000 for most cases). Unlike California or Midwest states, Arizona has streamlined procedures. Most informal probates can be completed efficiently with experienced guidance.

Myth #3: Small Estates Don't Need Probate

The Truth: Size doesn’t automatically eliminate probate requirements. Arizona’s 2025 small estate limits are $200,000 for personal property and $300,000 for real estate. Even qualifying estates need proper legal documentation—many families miss these opportunities because they don’t know the current rules.

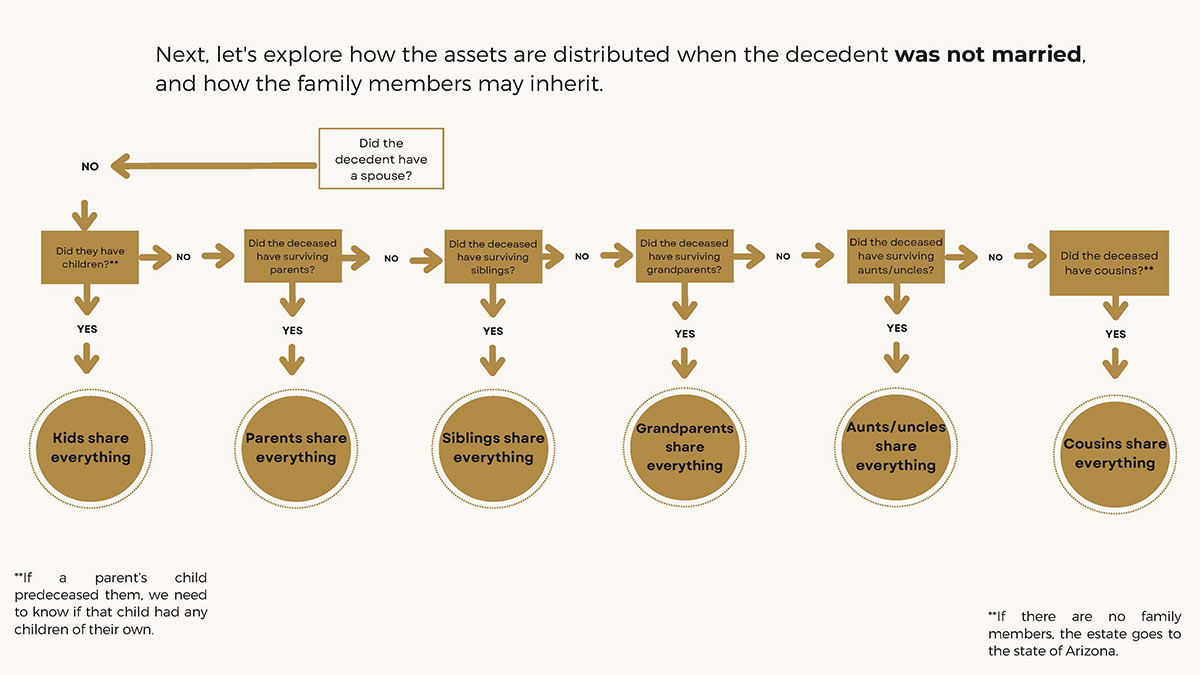

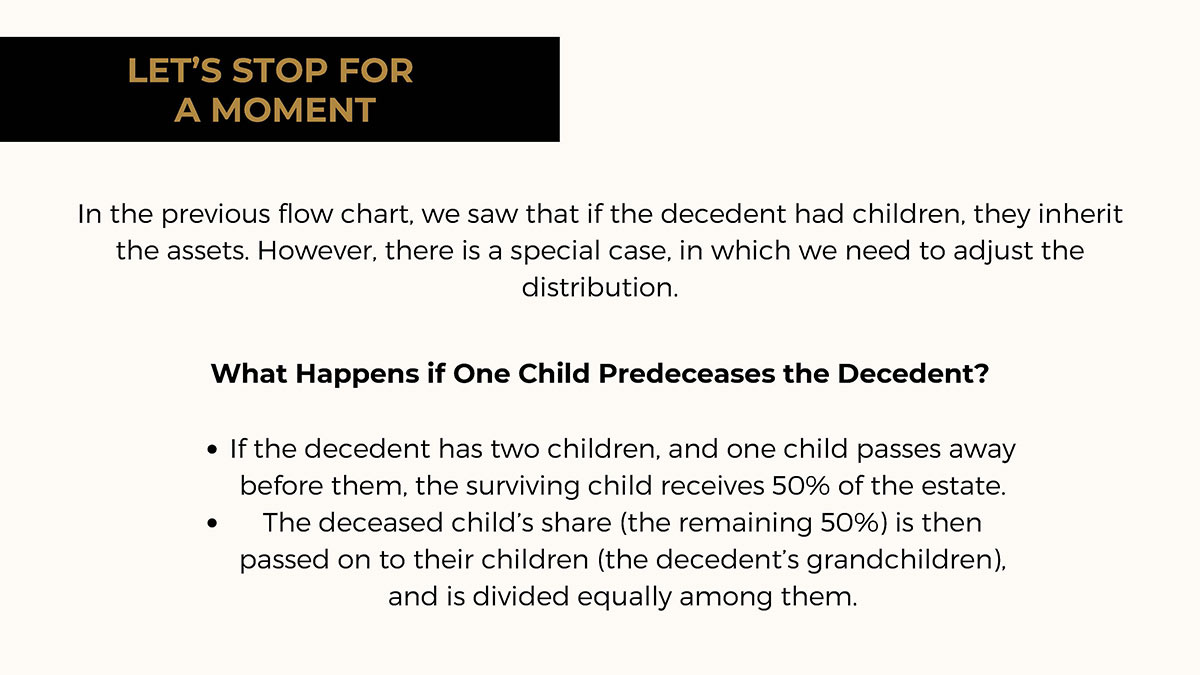

Myth #4: The State Takes Everything If You Die Without a Will

The Truth: Arizona has clear intestate succession laws distributing assets to family members—not the state. Surviving spouse comes first, then other relatives. The state only inherits if no eligible family exists, which is extremely rare.

Myth #5: Being Named in Someone's Will Makes You Automatically the Personal Representative

The Truth: You must still be officially appointed by the probate court before acting on behalf of the estate. Until you have legal authority, you can’t collect assets, pay debts, or distribute property. This requires court filings and formal legal responsibilities.

Myth #6: Probate Is Always Contentious and Causes Family Fights

The Truth: Most Arizona probate cases proceed smoothly with well-drafted wills. Informal probate has minimal court supervision when wills aren’t challenged. Family disputes typically arise from poor communication or unclear estate planning—not from probate itself.

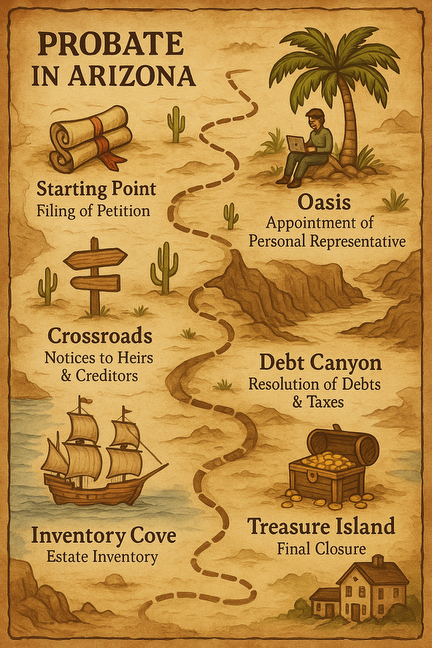

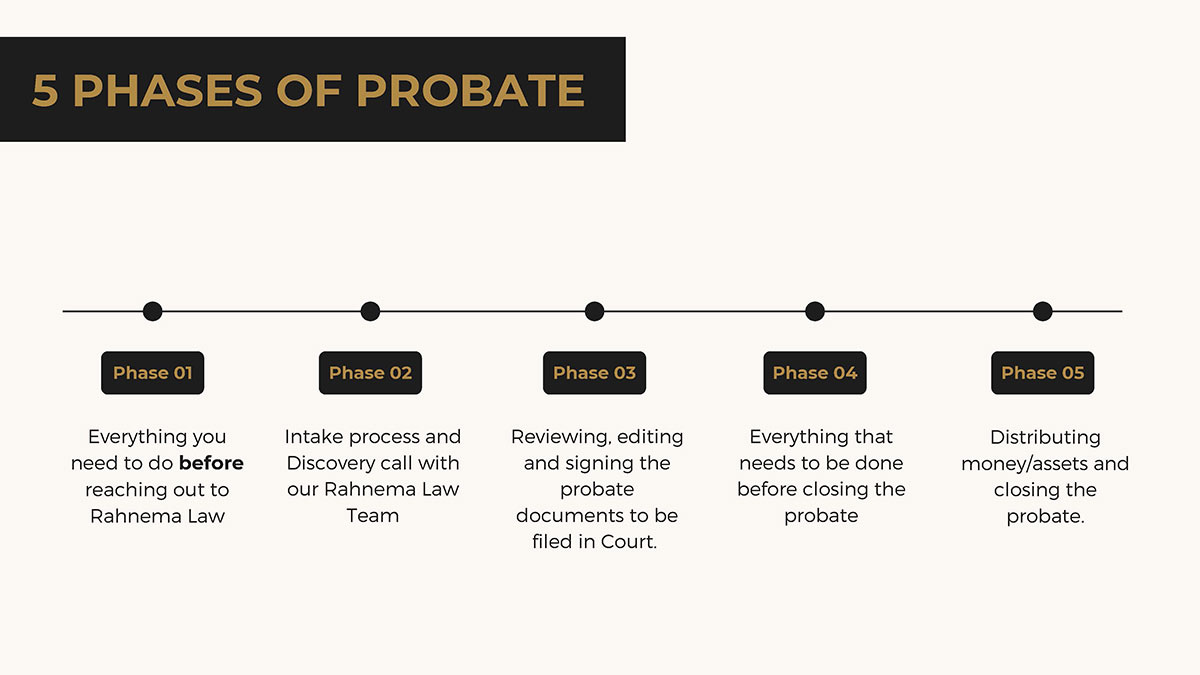

Our Step-by-Step Approach to

Probate Administration

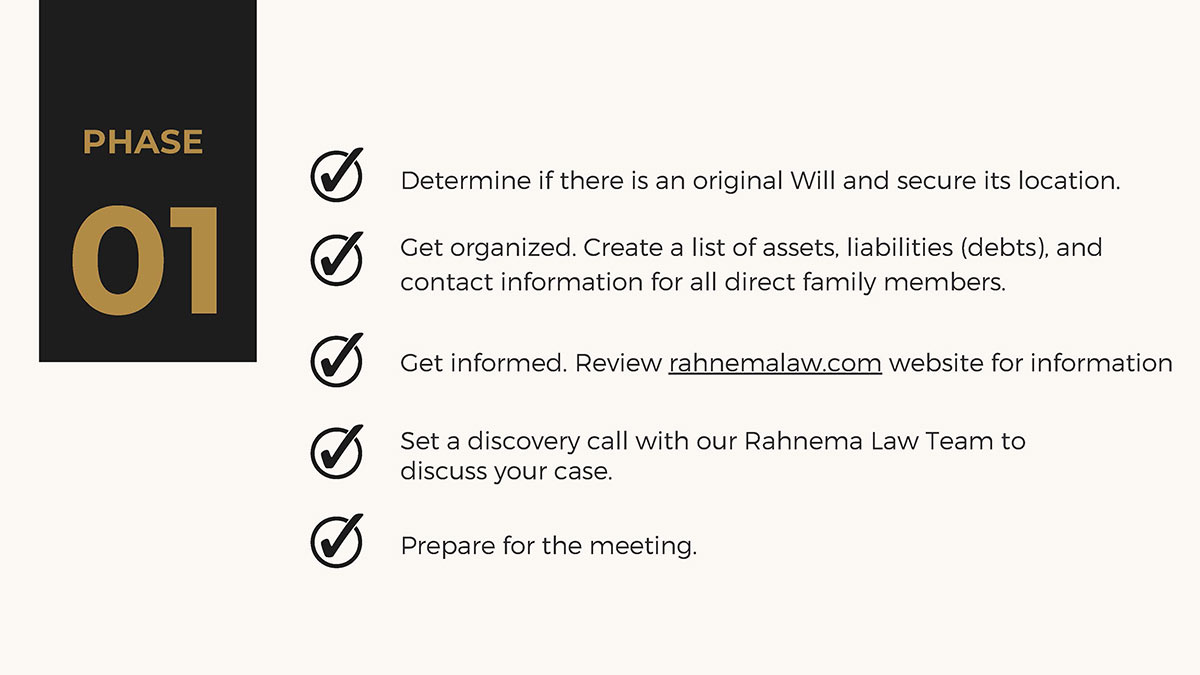

Phase 01

Steps to Take Before Getting Started

- Determine if there is an original will and secure its location.

- Get organized. Create a list of assets and liabilities (debts).

- Get informed. Review rahnemalaw.com website for information.

- Set a discovery call with our Rahnema Law Team to discuss your case.

- Prepare for the meeting.

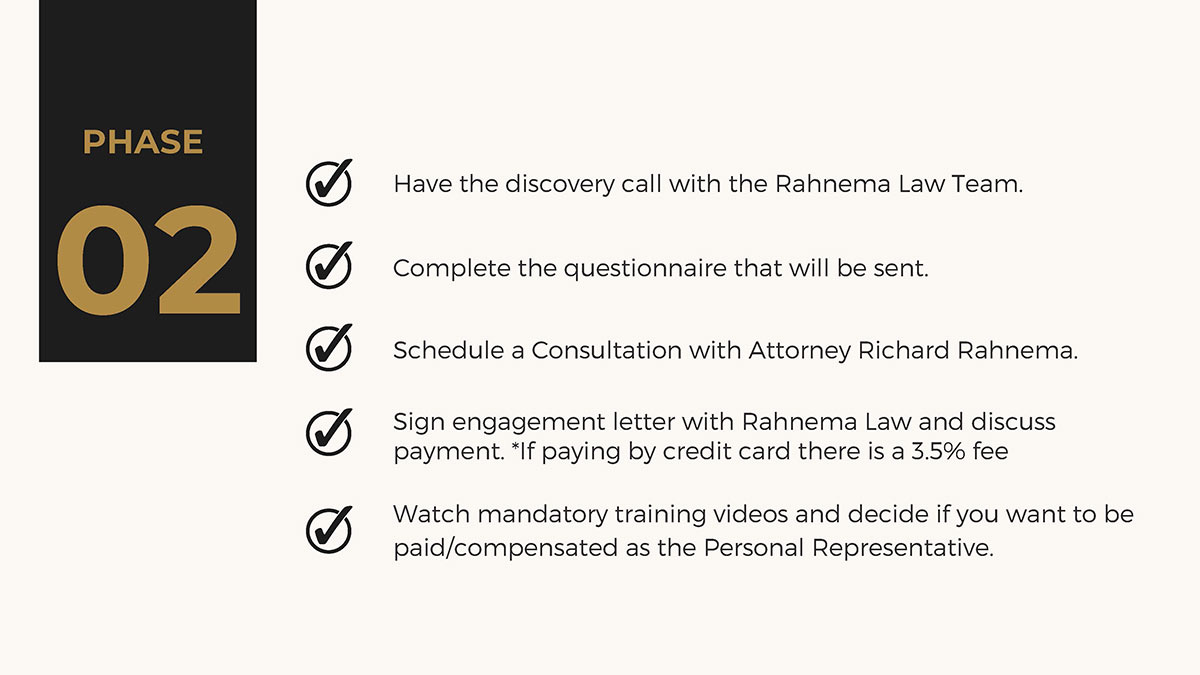

Phase 02

Intake process and Discovery call with our Rahnema Law Team

- Have the discovery call with Yami, our Legal Intake Specialist.

- Fill out the questionnaire that will be sent to your email.

- Schedule a Consultation with our lawyer Richard Rahnema.

- Sign the engagement letter with Rahnema Law. We accept alternative payment methods such as cash or bank transfer to help clients avoid standard processing fees.

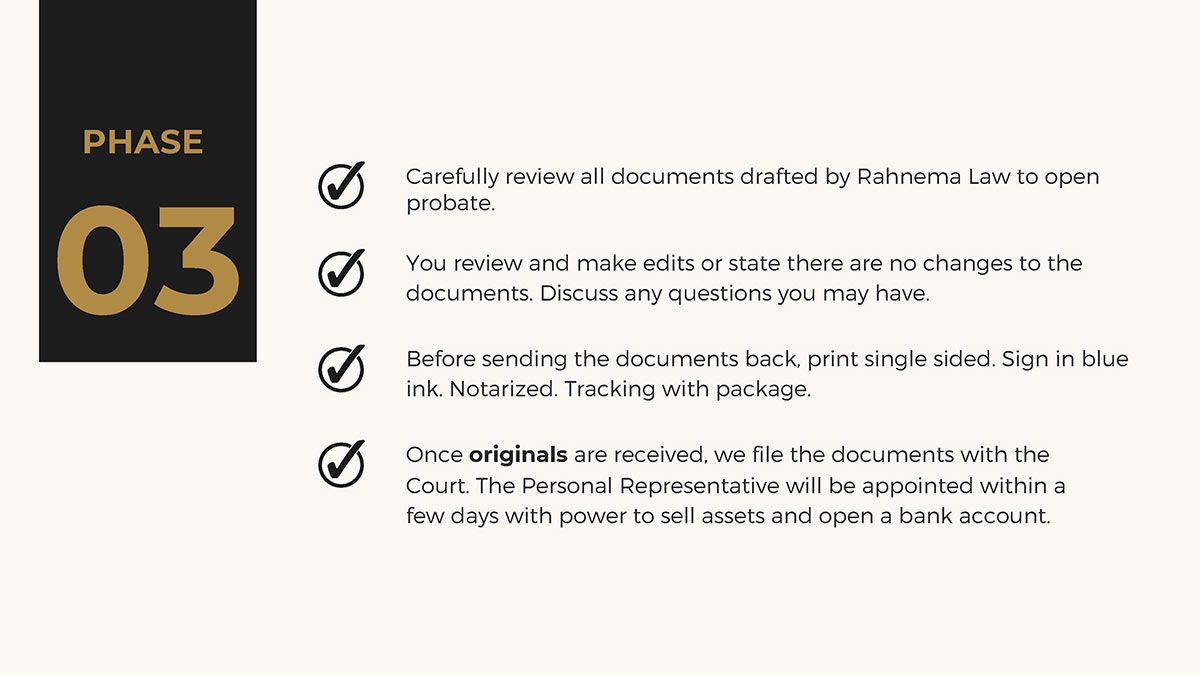

Phase 03

Everything necessary before “opening” probate

We’ll send you all the court-ready documents. You’ll review, sign, and return them — and we’ll handle the filing with the court.

In this phase, we prepare and submit all necessary court documents.

Carefully review all probate documents drafted by Rahnema Law.

- Provide your feedback or confirm no changes are needed.

- Complete final signing and notarization of documents.

- We will then file the original documents with the Court.

- Watch mandatory training videos and decide if you want to be paid as the representative.

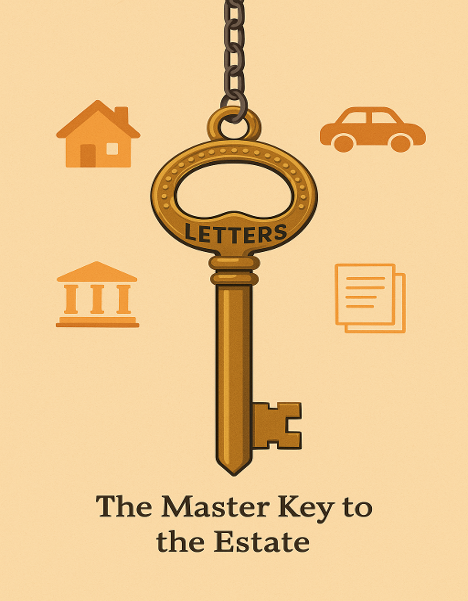

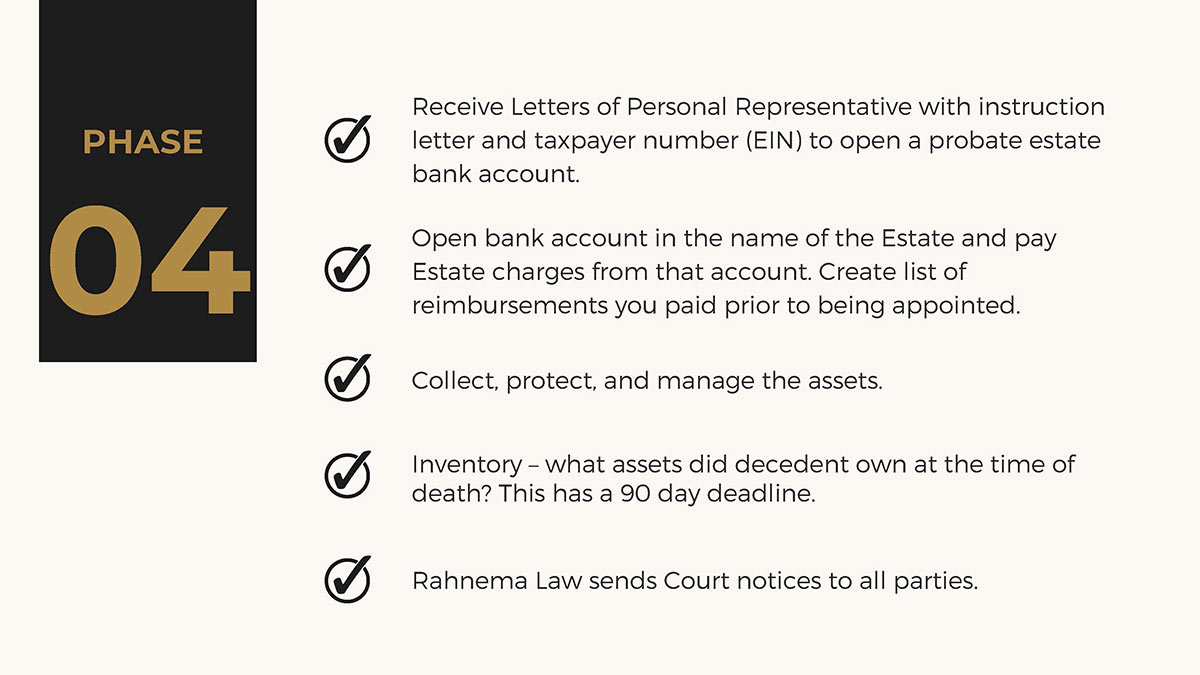

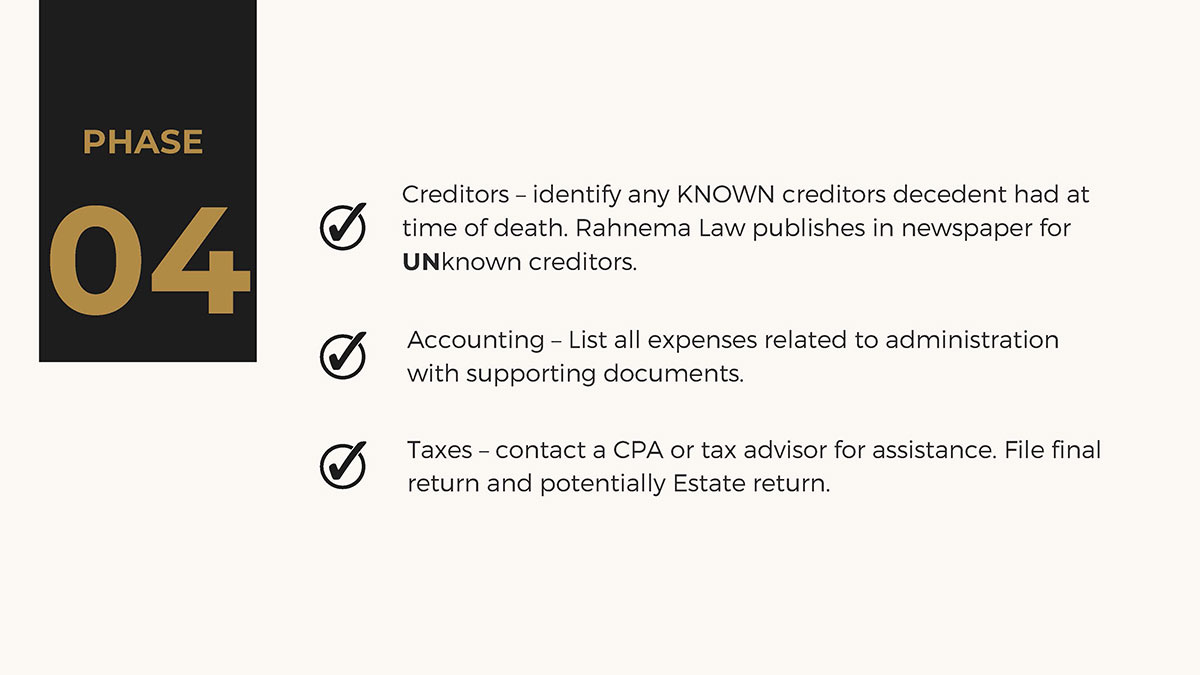

Phase 04

Managing the Estate Once Appointed

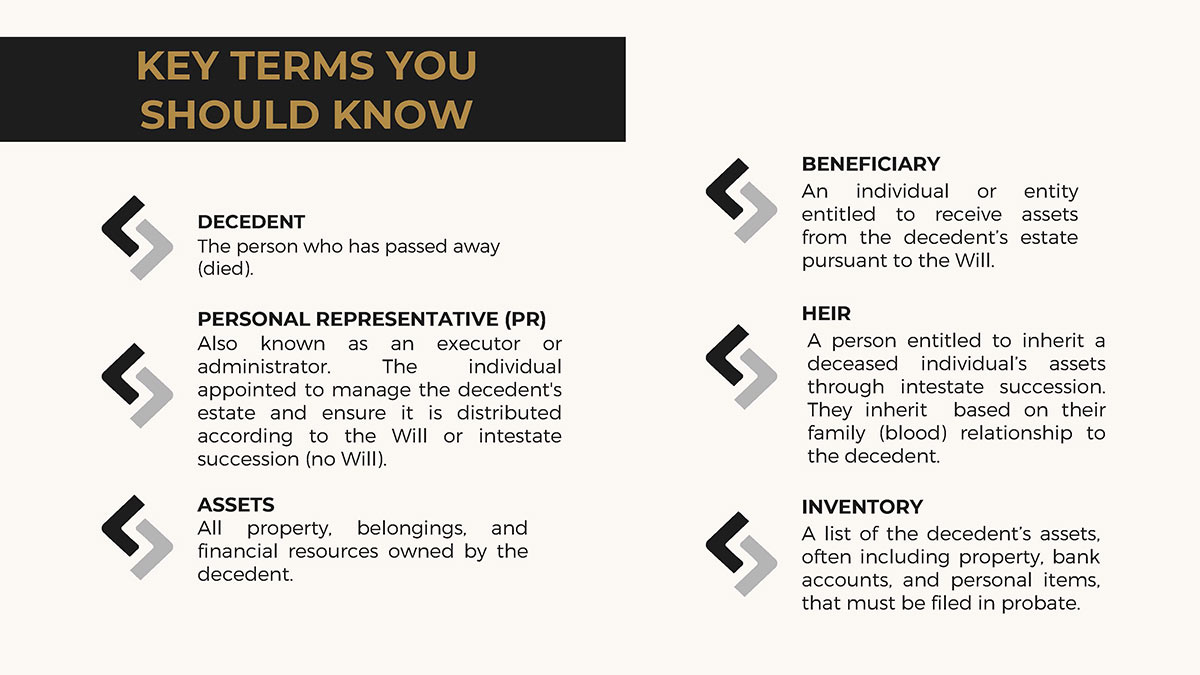

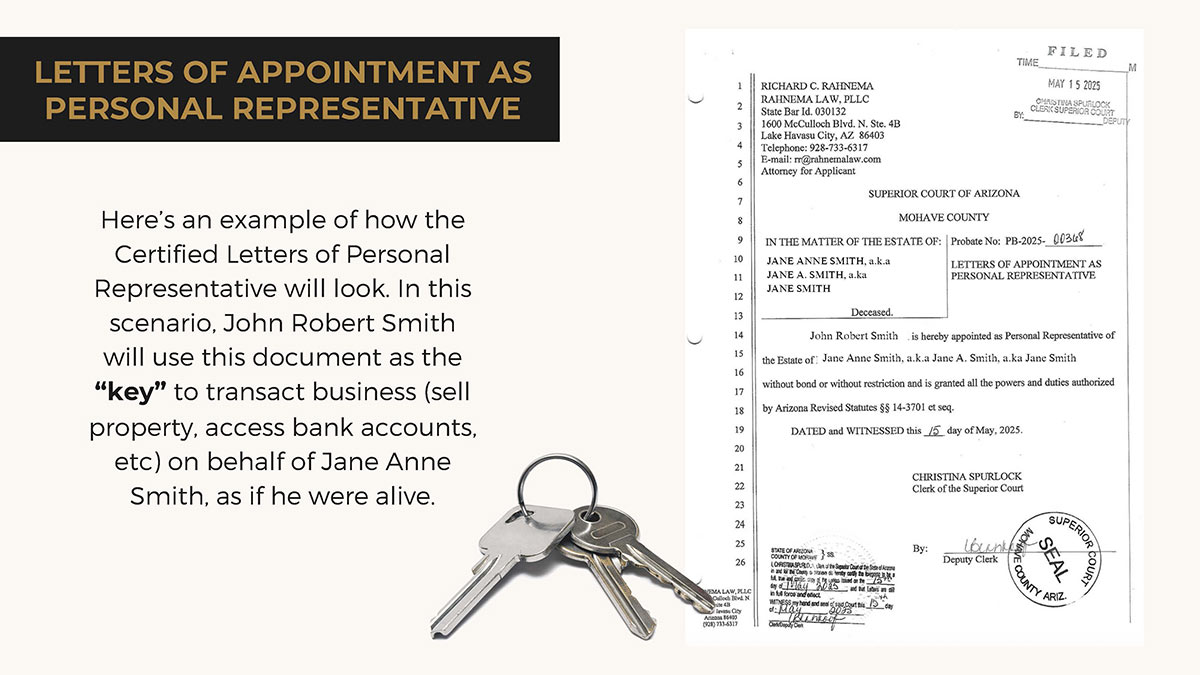

- Receive Letters of Personal Representative with instruction letter and taxpayer number (EIN) to open a probate estate bank account.

- Open bank account in the name of the Estate and pay Estate charges from that account. Create list of reimbursements you paid prior.

- Collect, protect and manage the assets.

- Inventory – what assets did decedent own at the time of death? This has a 90 day deadline.

- Rahnema Law sends Court notices to all parties.

- Creditors – identify any KNOWN creditors decedent had at time of death. Rahnema Law publishes in newspaper for Unknown creditors.

- Accounting – List all expenses related to administration with supporting documents.

- Taxes – contact a CPA or tax advisor for assistance. File final return and potentially Estate return.

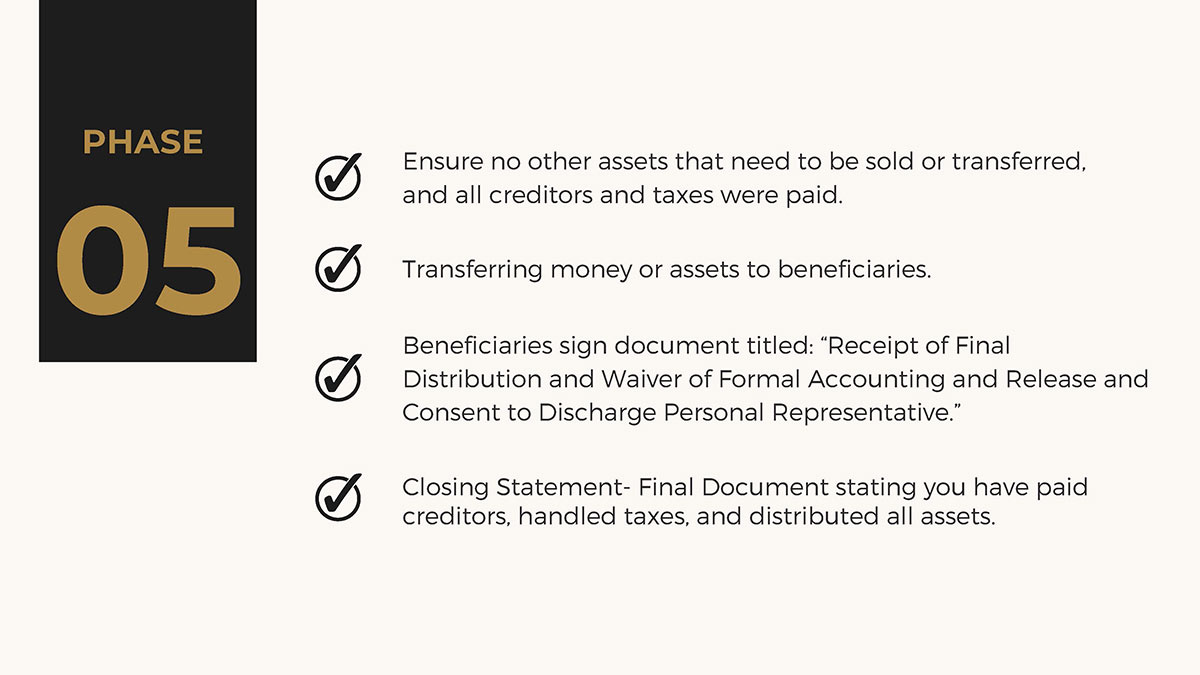

Phase 05

Distributing money/assets and closing the probate.

- Ensure no other assets that need to be sold or transferred, and all creditors and taxes were paid.

- Transferring money or assets to beneficiaries.

- Sign document titled: “Receipt of final distribution and waiver of formal accounting and release and consent to discharge personal representative”.

- Closing Statement- Final Document stating you have paid creditors, handled taxes and distributed all assets.

Get the Help You Deserve

Let Rahnema Law handle the legal complexities of probate administration so you can focus on what truly matters—honoring your loved one’s legacy.